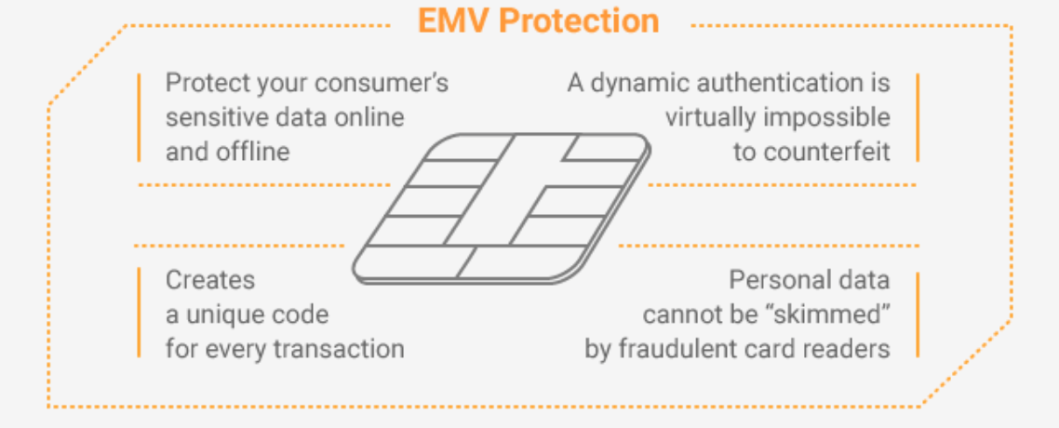

As the owner of an ATM, you may have heard about the upcoming “liability shift” set to take place in October 2016. Starting fall of 2016, credit card companies will no longer be held liable for fraudulent ATM transactions, such as card-skimming. As a result, if your ATM isn’t capable of reading the new credit cards with the small chips embedded in them (EMV cards or ‘smart cards’), you as the ATM operator will be held liable for this fraudulent activity instead. If you own and operate an ATM that is not equipped with an EMV-capable card reader you should be concerned, if anything fraudulent happens at your ATM, you or your company will be personally held responsible.

Starting Fall 2016, ATMs must contain EMV Co-approved card readers as well as PCI-compliant encrypting PIN pads. U.S. ATM merchants have the choice of installing motorized EMV card readers or EMV dip card readers. If you have an ATM that isn’t EMV compliant you’ll need to upgrade your machine’s card reader. Most ATMs out there have EMV card reader upgrade kits available online.

Starting Fall 2016, ATMs must contain EMV Co-approved card readers as well as PCI-compliant encrypting PIN pads. U.S. ATM merchants have the choice of installing motorized EMV card readers or EMV dip card readers. If you have an ATM that isn’t EMV compliant you’ll need to upgrade your machine’s card reader. Most ATMs out there have EMV card reader upgrade kits available online. The kit includes the EMV card reader, a mounting bracket, a card reader bezel, some cables and reset board. Although the kits come with instructions, installing them can sometimes be tricky. You might want to hire a professional ATM technician to do the job.

The kit includes the EMV card reader, a mounting bracket, a card reader bezel, some cables and reset board. Although the kits come with instructions, installing them can sometimes be tricky. You might want to hire a professional ATM technician to do the job. New EMV approved ATM software interfaces with the EMV card reader and performs tasks such as authorizing users, communicating their transaction requests to issuers, and completing transactions.

New EMV approved ATM software interfaces with the EMV card reader and performs tasks such as authorizing users, communicating their transaction requests to issuers, and completing transactions. The ATM network must undergo end-to-end EMV hardware and software testing, in order to receive certification from the card networks whose cards the acquirer wants to accept.

The ATM network must undergo end-to-end EMV hardware and software testing, in order to receive certification from the card networks whose cards the acquirer wants to accept.